Ways To Give

Your Giving Is Changing Lives

You can support the work Fifth Ward Church of Christ is doing in your community.

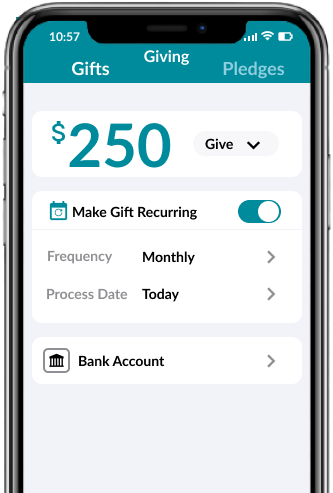

- Sign on for using the Realm Connect App and for giving with your mobile device

- Realm Online by going to Giving Page

- One-time and recurring giving options

Other Ways to Give

You re not restricted to monetary donations alone; we gladly welcome non monetary gifts, such as:

- Stock E-Giving

- Crypto Currency

- Donor Advised Fund

The Easiest and Most Effective Path To Give.

Experience convenience in giving through the Fifth Ward Church of Christ Realm Connect app. Easily set up recurring gifts and explore additional seamless options—all within the app’s user-friendly interface.

Online Giving and Payments to Church Events

We are grateful for your support of the Fifth Ward Church of Christ. Online Giving allows contributions or payments for church events to be made electronically. The application allows for the setup of recurring or one-time donations. Changing the payment date or contribution amount can be made at any time.

Online Giving FAQs

For more questions, email us at fwcc-ap@fwcoc.org.

Online Giving is a method whereby your contribution or event payment is debited to the church from your checking, savings, or credit card account.

It makes it easy to fulfill stewardship commitments, even when you can’t attend worship services. You never have to bring cash or write checks to church. Giving electronically also helps the church save money and improve its budget!

Your contributions will automatically be deducted from your checking account or charged to your debit/credit card on the specified date. A receipt confirmation email for each contribution or event payment is sent to you.

Yes. You can do both by selecting the applicable event from the drop-down list.

Simply log in. In the My Accounts Section, update your account information and create a new recurring schedule.

You can cancel your authorization by deleting your accounts and donation dates.

Complete the online registration form and select the donations and the amount you would like to donate along with your E-check, credit, or debit card information. It’s that easy!

The church-issued contribution statement is the only record accepted for reporting cash donations per IRS regulations.

Realm FAQs

For more questions, email us at fwcc-ap@fwcoc.org.

- Go to onrealm.org/FWCOC.org. Your user name and password are the same as using the Realm Connect App

- No. An account is not required for giving from the church website. To see your giving history or set up recurring gifts and payments, you must be a member and have an account.

- Can I give to more than one fund and also pay for an event in the same transaction?

- Yes. Click another fund and select the gift frequency and complete the payment screen.

- Yes or log in to your Realm account to make gift.

- No. Your giving transactions are recorded in Realm. If you have a recurring profile in the previous giving portal, please delete it.

- With a computer you can download or print your statement between February 1st and April 30th.

Donor-Advised Funds FAQs

For more questions, email us at fwcc-ap@fwcoc.org.

- A donor-advised fund is a vehicle that allows investors to donate directly to a charitable fund while retaining some control over their assets.

- Donor-advised fund administrators are public charities such as a church that qualify as 501(c)(3) non-profit organizations.

- Donors can benefit from an immediate tax deduction when they contribute cash to the fund.

- The main requirement is that donations go to a qualified charitable organization.

- You must have a giving fund account at a public charity such as Bank of America Charitable Giving, Charles Schwab, or Fidelity Charitable.

- You control the amount and choose from a list of charitable organizations to donate that are registered with an advisor-fund.

- The church is registered with National Philanthropic Trust, YourCause, NPO Connect, and FrontDoor CyberGrants to receive cash donations.

Crypto Currency Giving FAQs

For more questions, email us at fwcc-ap@fwcoc.org.

- Crypto currency, also known as Virtual Currency or “Crypto,” is a digital asset designed to function as an alternative to sovereign fiat currency (US Dollars, for example) whereby transactions between two parties are verified through a public, distributed ledger, also known as a blockchain. Most people think of Bitcoin and/or Ether when they hear the word “Crypto,” and while Bitcoin is the original cryptocurrency and most widely followed, there are a number of cryptocurrencies currently available.

- Yes and a donation receipt is sent to the donor

- Yes. The donor is required to file IRS Form 8283 provided by engiven.com and have a crypto currency appraisal by an accounting firm in it’s records for donations exceeding $5,000

- Click on the link to the crypto currency given page for additional information and instructions to give

Stock E-Giving FAQs

For more questions, email us at fwcc-ap@fwcoc.org.

- Stock gifts are donations of shares of stock that you own in a public company, private company, or mutual fund.

- It allows donors to avoid both capital gains tax, meaning increase in value, and state income taxes that they would otherwise need to pay if they sold the stock to donate cash.

- Additional donor can claim a charitable deduction for the current fair market value of their stock at the time of donation.

- Yes You will receive a ____ from engiven of your stock giving donation to report on your annual tax return.

- Click on the link to the Stock e-giving page for additional information and instructions to give